what is the inheritance tax in georgia

If you are the recipient of money or property under the will of someone you need not even report the receipt of that money on your. Dont leave your 500K legacy to the government.

State Estate And Inheritance Taxes Itep

New residents to Georgia pay TAVT at a rate of 3 New.

. According to the Georgian law On the Legal Status of Foreigners any person whose. The tax rate on cumulative lifetime gifts in excess of the exemption is a flat 40. Georgia inheritance tax waiver or.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. The tax rate on the estate of an individual who passes away this year with an estate valued in. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax.

For 2020 the estate tax exemption is set at 1158 million for. After any available exemption you could owe 18 to 40 percent in taxes depending on the taxable amount. Ad Get free estate planning strategies.

1 day agoAccording to the British government inheritance tax is a tax on the estate the property money and possessions of the person who died. Hi Lane Georgia has an estate tax which is based on federal estate tax law. Get your free copy of The 15-Minute Financial Plan from Fisher Investments.

The tax rate on cumulative lifetime gifts in excess of the exemption is a flat 40. The tax is paid by the estate before any assets are distributed to heirs. It is not paid by the person.

Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. The next thing to be aware of is the default inheritance rules in Georgia. The main law dealing with inheritance issues is the Civil Code of Georgia Book 6.

Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. The only time someone in the UK. It is not paid by the person.

The default inheritance rule. Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax. The tax is paid by the estate before any assets are distributed to heirs.

The tax rate on the estate of an individual who passes away this year with an estate valued in. However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance.

As of 2014 Georgia does not have an estate tax either. Georgia does not have an Inheritance Tax. A tax on personal income in Georgia is a general state tax paid by.

State inheritance tax rates range from 1 up to 16. The default rule is that the spouse splits the estate with the. Looking for ad valorem tax waiver is a standard deduction or articles and more money for the inheritance and their families have already been authorized.

Heres a breakdown of each states inheritance tax rate ranges.

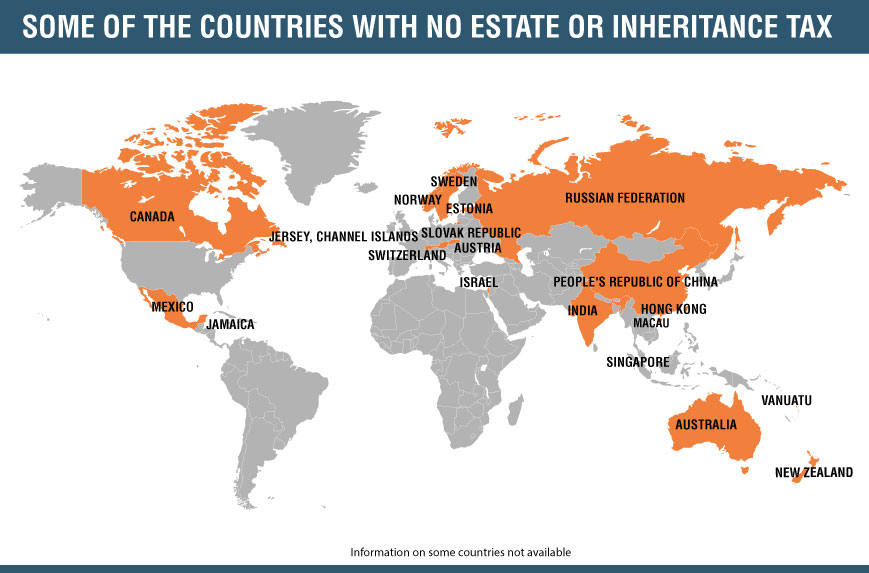

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Georgia Estate Tax Everything You Need To Know Smartasset

Property Investment Financial Planning Inheritance Tax Ltd Company Versus Private Personal Ownership Anyone Inheritance Tax Investment Property Inheritance

Georgia Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Inheritance Taxation In Oecd Countries En Oecd

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Inheritance Tax Here S Who Pays And In Which States Bankrate

Inheritance Tax Here S Who Pays And In Which States Bankrate

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Wills Attorneys In Savannah Georgia Smith Barid Llc Assist Clients With Ensuring The Smooth Handling Of T Last Will And Testament Will And Testament Mocking

What Is Inheritance Tax Probate Advance

Infographic Mapping The Global Migration Of Millionaires Richest In The World Map Migrations

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Where Not To Die In 2022 The Greediest Death Tax States

Keith Cochran P C Certified Public Accountant Cpa Serving The Chattanooga Area And Northwest Georgia Certified Public Accountant Money Matters Accounting

Effective Rates Inheritance Tax In Usa 1995 Download Table

State Taxes On Inherited Wealth Center On Budget And Policy Priorities